What is the Disabled Veteran Motor Vehicle Tax & Fee Exemption?

Starting January 1, 2026, all disabled and/or blind veterans in Nebraska can receive an exemption for the Motor Vehicle Tax and Motor Vehicle Fee for ONE vehicle owned and used for their personal transportation.

NOTE: if a veteran has multiple vehicles, it is recommended they look at their vehicle registration document(s) and determine to which vehicle they wish to apply the exemption.

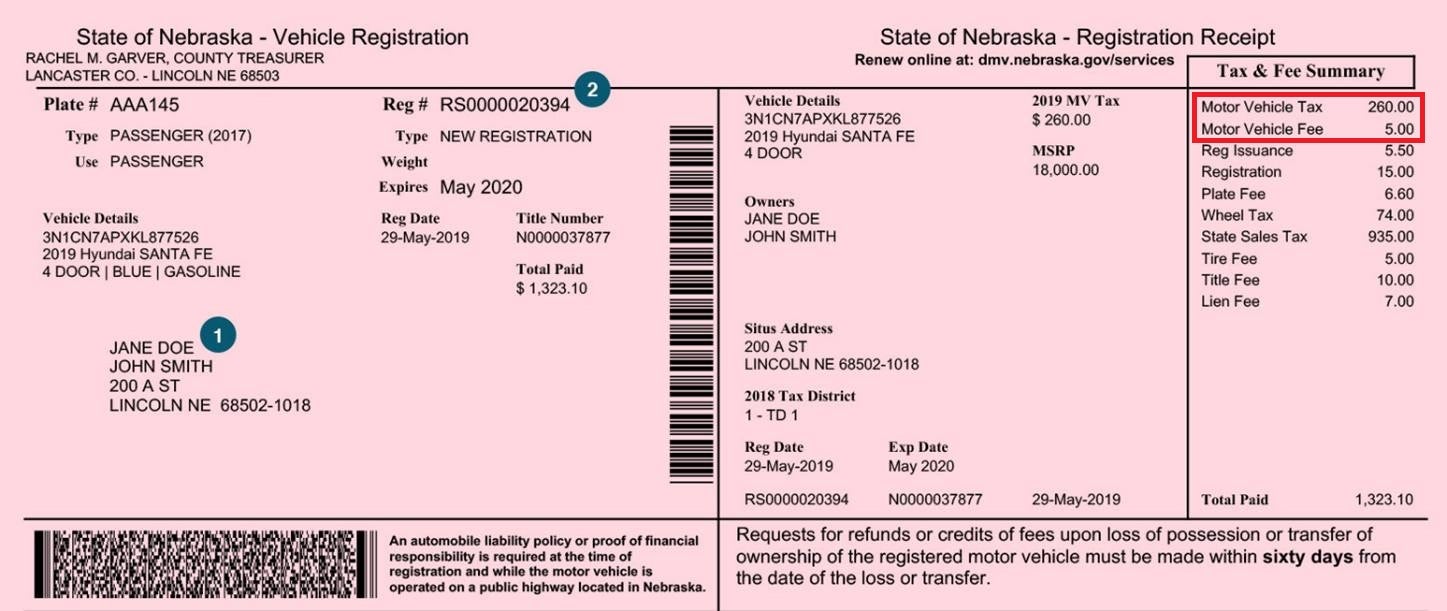

The exemption only applies to the Motor Vehicle Tax and Motor Vehicle Fee. All other taxes and fees (e.g. plate fee, sales tax, wheel tax, etc.) still need to be paid. The outlined portion of the example registration below shows the tax that would be exempted under this new law.

Who qualifies for the tax exemption?

LB650 defines “Disabled Veteran” as meaning the same as 5 U.S. Code § 2108, which outlines two methods to meet the definition of a disabled veteran under U.S. code:

- An individual who served on active duty in the armed forces, has separated under honorable conditions, and has established the present existence of a service-connected disability (covers those who are rated at 0%), or

- An individual who is receiving compensation, disability retirement benefits, or pension because of a public statute administered by the U.S. Department of Veterans Affairs (VA) or a military department.

LB650 defines “Blind Veteran” as a veteran whose sight is so defective as to seriously limit such veteran's ability to engage in the ordinary vocations and activities of life. Their disability or blindness must be recognized by the U.S. Department of Veterans Affairs, and they must have discharged or otherwise separated with a characterization of honorable.

For eligibility questions, please reach out to our State Service Office or your County Veterans Service Officer.

How does a veteran apply for the tax exemption?

First, the veteran MUST be in the NDVA Military & Veteran Registry as this is how DMV will verify eligibility. Veterans must include a benefit summary that shows a service-connected disability rating or demonstrates the veteran is in receipt of compensation, disability retirement benefits, or pension from the VA.

NOTE: it takes up to 48 hours after approval for registry applications to be processed and visible to DMV. Applications received after 5 p.m. CT on Friday will be processed the following Monday and in the DMV database by Tuesday or Wednesday.

Once in the registry, the veteran needs to do the following when registering or renewing:

In person – tell the county treasurer staff they qualify for the disabled veteran tax exemption.

Via mail – include a note requesting the exemption along with your social security number.

Online – on the second step (Eligibility) check the box that says, "I am eligible for the disabled veteran motor vehicle tax and fee exemption and want to claim it on one of the vehicles I am renewing."

The veteran may need to provide their social security number when registering/renewing if it is not already associated with their registration record.

When does a veteran apply for the tax exemption?

The request for the tax exemption must occur within 30 days after the purchase of a vehicle. For registration renewal, the request must occur prior to the final day of the expiration month. If the request is outside the required timeframe, the veteran will not qualify for the exemption until the next renewal period.

Can the tax exemption be transferred to another vehicle?

Yes. If a veteran wishes to transfer the exemption to a different vehicle, this must be done at the time the vehicle is sold or during the month of expiration of the existing vehicle.

Does a veteran have to apply for the tax exemption every year?

No. The exemption will automatically be applied to future renewals unless the veteran requests it is transferred to another vehicle.

Additional Resources

To apply to the Military & Veteran Registry, click here.

For assistance obtaining your DD-214 or other discharge paperwork, click here.

To find your County Veteran Service Officer's contact information, click here.

To find your County Treasurer's contact information, click here.

For questions on vehicle registrations and renewals, contact the Nebraska DMV at 402-471-3918 or by visiting this page.